During times of Pandemics and disasters we realise all the more importance of few industries, which impacts economies drastically. One such industry in the Reinsurance industry or Insurance industry in totality. On March 11, 2020, the World Health Organization declared the novel coronavirus disease (COVID-19) outbreak a pandemic. Presently, there appears to be some consensus that the extent to which the reinsurance markets will bear COVID-19 losses will be driven by the insurance of major events. This necessarily will require insurers to identify the “event” from which its losses emanate, this question may be debated for years to come and is unlikely to present a simple or singular answer. The CCRS analysis predicted a total loss to the insurance industry ranging from $456 billion to $775 billion with the greatest loss experienced by L&H classes of business as a result of the large number of people who require medical services during the pandemic and the number of fatalities that occur over a short period of time. (Source – Norton Rose Fulbright blogs) Here’s a small try to understand the industry and it’s interests.

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on (“cedes”) some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a “ceding company” or

“cedent” or “cedant” under most arrangements. The company issuing the reinsurance policy is referred simply as the “reinsurer”.

In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company’s capital requirements, or for tax mitigation or other purposes.

The top 10 biggest global reinsurance groups (Non-Life business) by unaffiliated: gross premium written in 2018:

- Munich Reinsurance Company

- Swiss Re Ltd.

- Lloyd’s

- Hannover Rück SE

- Berkshire Hathaway Inc.

- SCOR S.E.

- Everest Re Group Ltd.

- PartnerRe Ltd

- XL Bermuda Ltd.

- Transatlantic Holdings, Inc.

Major Sources of Operating Revenue:

- Gross Premium received – Premiums received from insurance companies against reinsurance contracts underwritten.

- Investments income.

- Fee Income from signing or entering into reinsurance contracts, if any.

Major Sources of Operating Expenses:

1. Claims made against reinsurance policies.

2. Operational expenses relating to reinsurance claims processing.

Major sources of Income:

1. Underwriting profit – It refers to Earned premiums as a free money when there is expiry of the claim period against a policy or portfolio i.e. no claims would be admissible against those paid premiums (e.g. Mediclaim policy taken for an year, once the premium is paid and after a year there is an expiry of the policy without any claims, the premium earned is called underwriting profit).

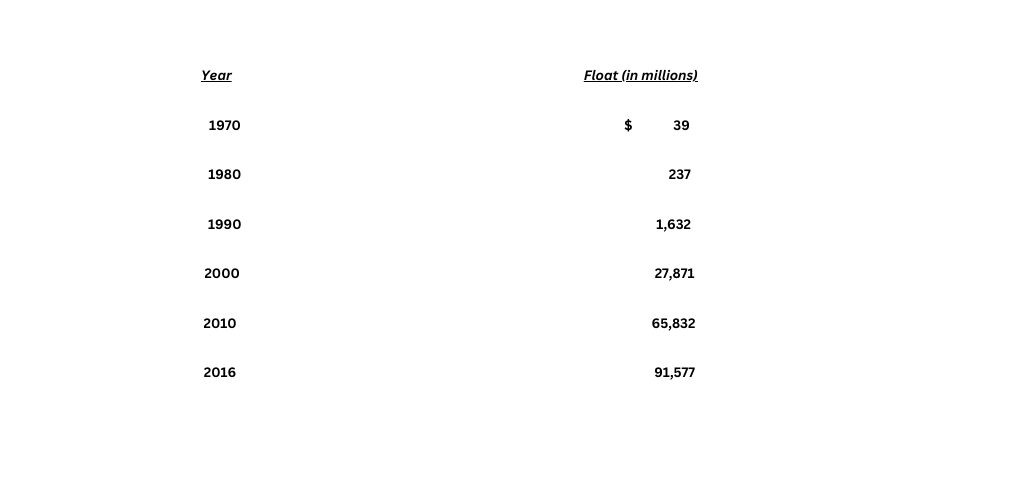

2. Investment income from Insurance float money – Insurance Float money refers to the money available for usage by the reinsurance company to invest and earn income in between the period when the premium is received, and the claim is actually incurred (i.e. before claims are provisioned for and processed).

Understanding Reinsurance in layman definition:

1. Why does one buy an insurance policy?

- To hedge oneself against a risk of a casualty or mis happening or untoward situation.

2. Who provides direct Insurance policies?

- Insurance companies deal in direct selling of policies.

• How does it make a business sense when you assure an insurance of an amount equal to the value of the underlying object, event or casualty which is significantly higher against a significant less amount of premium?

• Imagine selling a motorbike maintenance insurance policy.

• You sell this insurance policy to a single person at a premium of Rs. 10 to insure a car repair amount of Rs. 100 – This is the only part which makes insurance contracts so attractive since against a comparatively smaller amount of premium the guaranteed return based upon a contingency is significantly and comparatively higher. (for an insured – imagine price of Futures, against a smaller value to purchase Futures you trade or bet upon a comparatively higher valued underlying asset)

• For the Insurers understanding that the risk is too high, you sell this policy to 9 more customers,

• Hence, in totality you earn a premium of Rs. 100 (1010) while you could run into possible claim of Rs. 1,000 (10100),

• Here comes the tricky part basically termed as “Underwriting” an insurer in order to avoid the risk of 100% claim will sell the other 9 policies to those customers who may not be regular in getting their motor bike repaired or may not be travelling on such roads frequently which may result in repairs.

• In such a way the Insurance companies hedge risk against policies purchased by customers or significantly reduce the risk by spreading the risk across a larger number of policy holders with varied risk factors, geographies, nationalities, etc.

• How does Insurance companies earn profits?

- The easy or free money will basically be through earned premiums whose claim cycle has expired or written off claims which were not claimed or paid,

- The harder way of earning money and the most interesting part which makes the insurance industry such a favorite of Wall Street and even the legendary investor Mr. Warren Buffet is there ability to buy time to invest and earn returns from earned premiums and before any claim is filed against the paid premiums.

- If a company treats its float money better then others, it has more chances of winning the race towards better profitability.

- To share an example of how Berkshire Hathaway increased its float money wealth decade on decade:

• So how is Reinsurance industry different from Insurance industry?

- In layman understanding there is ideally no difference between an Insurance company and a Reinsurance company, if we replace insuring retail consumers with another insurance company then everything that an Insurance company does is similarly done by Reinsurance company.

- Also, Insurance contracts are to directly indemnify the insurer for any loss caused to the insured. Whereas reinsurance contract is more of a share of loss contract which relieves the insurance companies from risk of substantial losses in an event of excessive claims and give them a breather to free their capital against provisions to made for prospective or upcoming claims.

- However, Reinsurance have greater risk diversion and more free capital to make its availability and risk diversion done over many geographical boundaries and across nationalities. Through Reinsurance contract losses are more aptly estimated since most of the contracts are on shares loss basis or limit their losses.

- Moreover, Reinsurance companies usually have higher share in their portfolio of reinsuring P/C (Property & Casualty) contracts which basically gives upfront premiums while claims risks are spread over differential years based on the policies or the portfolio of policies. This gives huge boost to their float money.

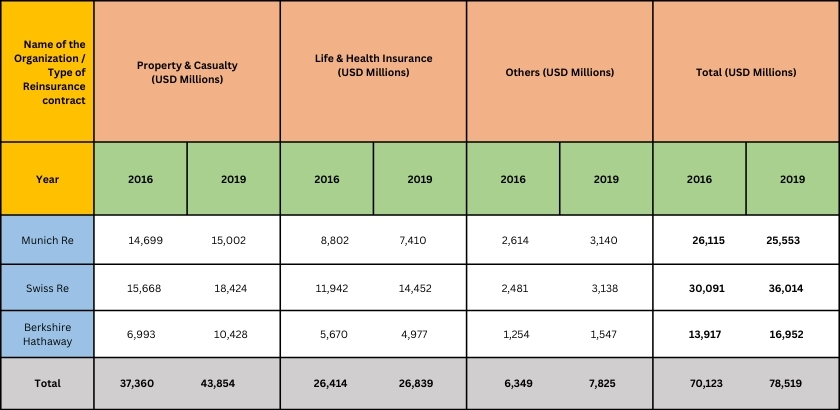

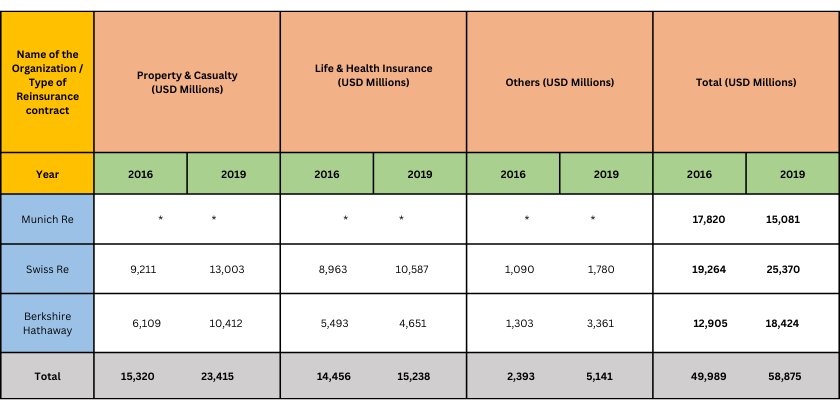

Sharing an Analysis of Gross Premium Written and insights of investments made by 3 most renowned masters of the industry:

*Data has been sourced from the reported Financial statements of the organizations from their respective websites.

Statement of Gross Premium Written in books:

- Gross premium is the total money that insurer writes in the books as revenue, however earned premium is the total premium earned on an expiry of the claim period.

Notes:

- Notably each one of the Reinsurers have increased their share of the P&C policies in their respective portfolios, between the year 2016 to 2019.

- While Swiss Re has also notably acquired higher volume of Life & Health Reinsurance policies, between the year 2016 to 2019. Infact Swiss Re has also divulged itself into acquiring more Life & health related policies in its direct insurance business.

- Berkshire Hathaway group has got 2 subsidiaries under it which is engaged in Reinsurance business, these values has been derived from the Notes to accounts showing separate figures for these subsidiaries.

Statement of Claims paid or incurred during the year + Underwriting expenses:

*Munich Re’s Financial statements didn’t provide the Claim paid expenses at Insurance type level.

**Berkshire Hathaway has a unique reinsurance contract in its “Others” portfolio, named as “Retroactive Reinsurance” which basically indemnifies insured against policies which were based on past events. E.g. An event in the past has already occurred and the insured are raising claim requests currently against the same.

This year the claim was significantly higher against the written premiums.

Statement of Investments Category:

Notes:

- These investments are in totality from Company’s available cash & bank balance and will consist funds collected from Float. However, the proportion of investments will surely give the trend of investments interest of the respective organizations.

- The value of investments represents the book value which is basically determined based on

Accounting principles against the investment’s category. - The value of investments done by Reinsurance companies as decreased in between the years

2016 to 2019 however since Berkshire Hathaway is mainly an investment group hence investments from other companies in the groups have increased significantly against the investments done by its Reinsurance subsidiaries. - Clearly our European counterparts (Swiss Re & Munich Re) are more risk averse against our

USA counterpart (Berkshire Hathaway). It shows that why the Insurance industry is so in demand in the USA since industrialists realise the importance of Insurance Float fund.